NGIF Capital (“NGIF”) has been successfully advancing the hydrogen economy through innovation work since 2017.

As background, NGIF is a venture capital firm that invests in early-stage companies scaling breakthrough technologies for the natural gas and hydrogen industry. Its limited partners (fund investors) enjoy the strategic value they gain from a portfolio of hydrogen startups and the solutions they bring to their organizations. They can also realize financial returns provided by the fund to reinvest into their corporate hydrogen innovation cycle.

Their first fund, Cleantech Ventures Fund I (the “Fund”), is a $50MM industry-led venture capital fund primarily investing in Seed to Series A stage cleantech companies, including hydrogen startups. The fund’s limited partners are ARC Resources, ATCO Gas, Birchcliff Energy, FortisBC Energy, TC Energy, Tourmaline Oil, and TriSummit Utilities.

Their first hydrogen investment was in early 2022 in Ionomr Innovations (“Ionomr”), which focuses on producing advanced ion-exchange membranes that enhance the efficiency and cost-effectiveness of hydrogen production and fuel cells. The Fund invested in Ionomr’s US $15MM Series A round, co-led by Shell Ventures and Finindus and participated in by Chevron Technology Ventures, Pallasite Ventures, and others.

In December 2023, NGIF co-led Ionomr’s US $20MM Series A+ round with Pallasite Ventures, joined this time by Bekaert, Asahi Kasei, Tupras Ventures, and others. This financing helped Ionomr scale its production facilities, among other things.

Image: Hydrogen Pipeline Infrastructure

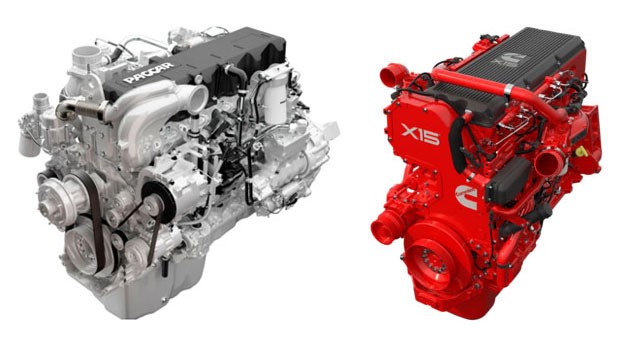

Their second hydrogen investment was also in early 2022 into Ekona Power (“Ekona”). Ekona is accelerating industrial-scale hydrogen production with its unique methane pyrolysis technology. This approach allows for low-carbon hydrogen production, minimizing emissions while addressing the growing demand for industrial hydrogen. The Fund invested in Ekona’s $79MM Series A round, led by Baker Hughes. Other investors included Mitsui, ConocoPhillips, TransAlta, Continental Resources, ARC Resources, and BDC Capital.

These venture-grade cleantech startups align with NGIF’s mission of advancing solutions within the hydrogen sector.

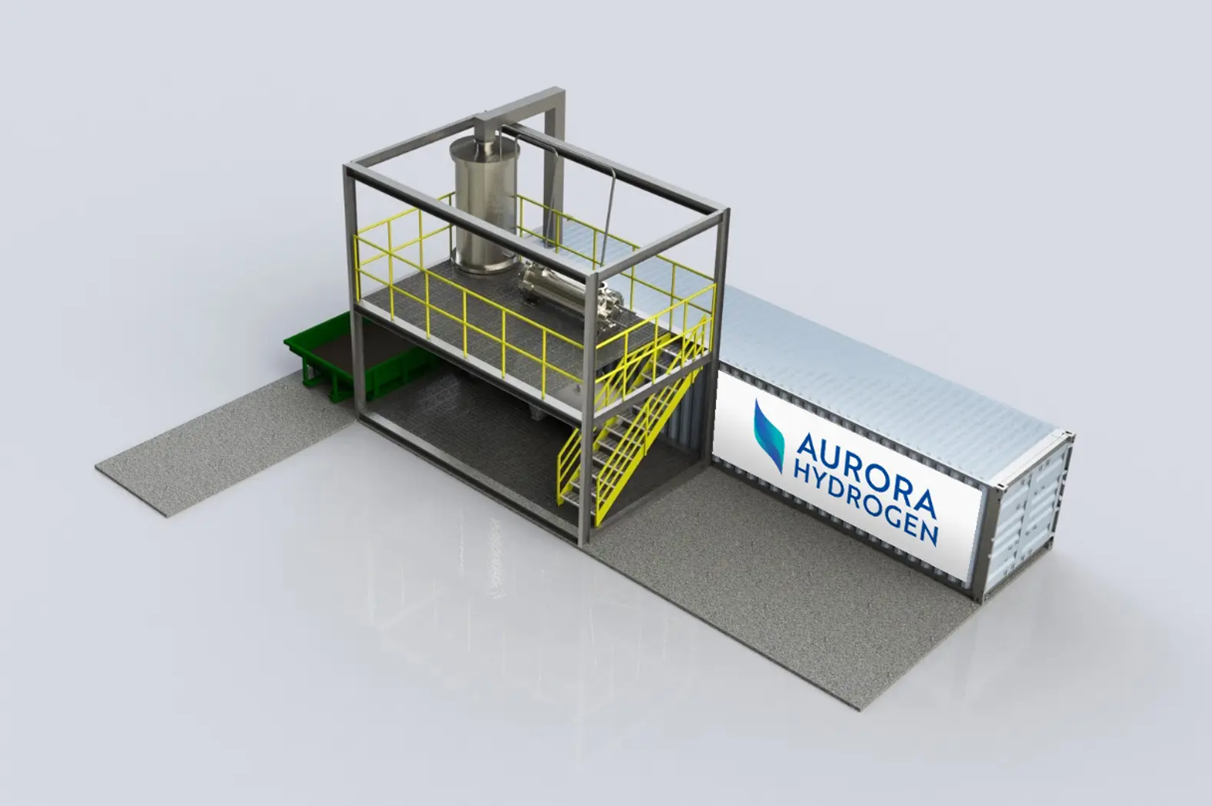

NGIF also has access to emerging hydrogen solutions through its technology and innovation subsidiary, NGIF Accelerator, and its Industry Grants funding program. This program has awarded $7MM in non-dilutive grants to 18 hydrogen-focused startups, with projects totalling over $138MM. These projects comprise groundbreaking technologies, including supersonic compression-based hydrogen production, microwave pyrolysis for blue hydrogen, and molten alloy reactors for methane pyrolysis, advancing progress in clean hydrogen production, hydrogen storage, and renewable power integration.

NGIF continues to advance the hydrogen economy through its strategic investments. If your organization is mandated to invest in hydrogen, please email jadams@ngif.ca.